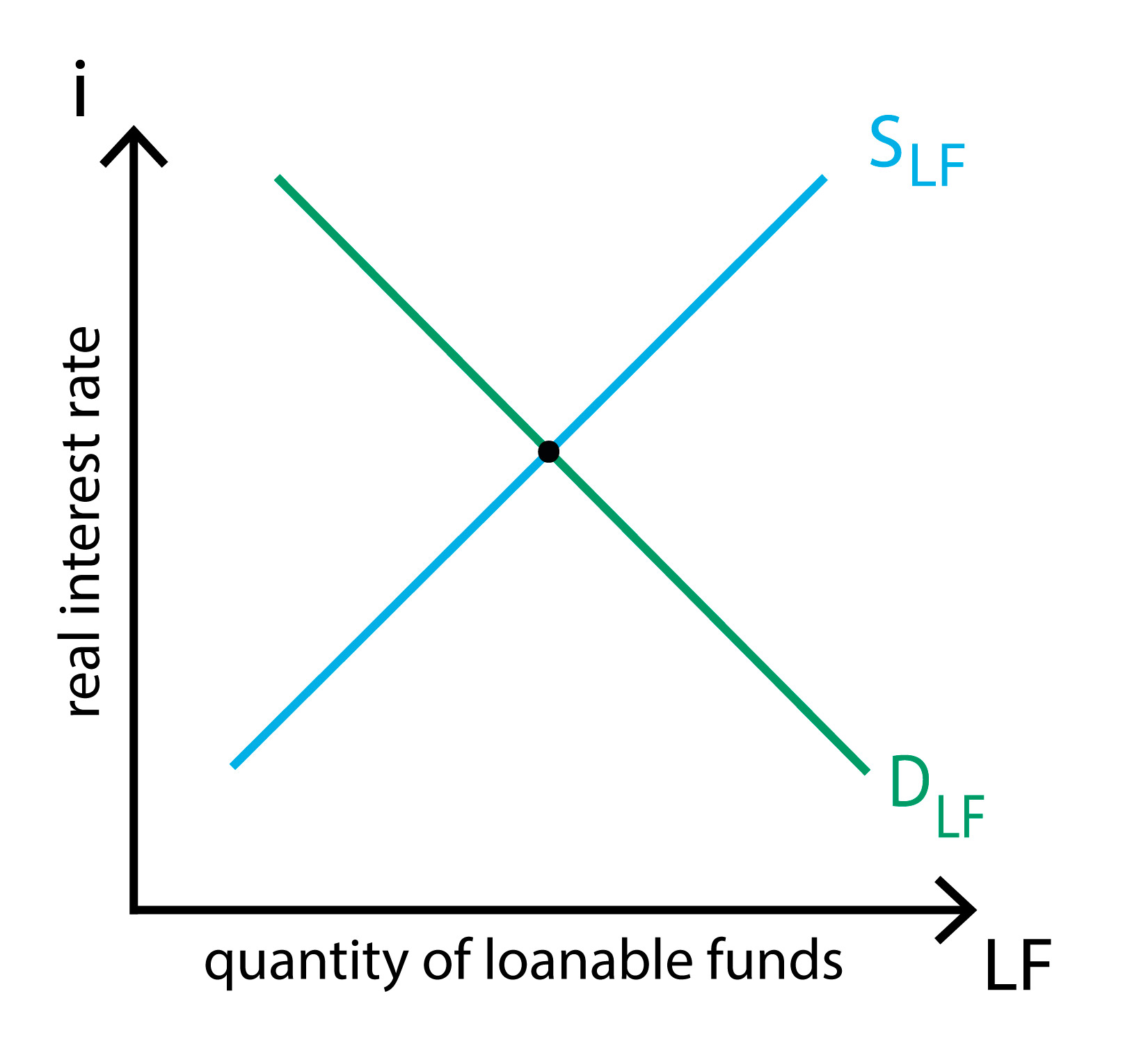

Loanable Funds Curve

Loanable Funds Curve. Investment and real interest rates 115: The supply curve for loanable funds is upward sloping, indicating that at higher interest rates lenders are willing to lend more funds to investors. The demand for loanable funds (dlf) curve slopes downward because the higher the real interest rate, the higher the price someone has to pay for a loan. For the market of loanable funds, the supply curve is determined by the aggregate level of savings the demand for loanable funds is determined by the amount that consumers and firms desire to invest. If aggregate income goes down, loanable funds go down, interest rates are going to be higher. In economics, the loanable funds doctrine is a theory of the market interest rate. We learned above that only the fed can shift the money supply curve, but what factors can affect the supply and demand curves for.

The loanable funds theory provides one possible answer to this question. Demand curve as marginal benefit curve. We learned above that only the fed can shift the money supply curve, but what factors can affect the supply and demand curves for. If aggregate income goes down, loanable funds go down, interest rates are going to be higher. • the loanable funds market includes: Investment and real interest rates 115: People who are interested in borrowing money are more likely to do so if the opportunity.

The market for foreign currency exchange.

Thinking about how real gdp can drive real interest rates watch the next lesson. If aggregate income goes down, loanable funds go down, interest rates are going to be higher. It might already have the funds on hand. When a firm decides to expand its capital stock, it can finance its purchase of capital in several ways. The term loanable funds includes all forms of credit, such as loans, bonds, or savings deposits. The supply curve for loanable funds is upward sloping, indicating that at higher interest rates lenders are willing to lend more funds to investors. The determinants of the supply of loanable funds (national savings) and demand for loanable funds (domestic investment + net foreign investment). The second curve represents those borrowing loanable funds and is called the demand for loanable funds line. If the supply of loanable funds increases (if people start to save more, for whatever reason), then, ceteris paribus, the price of loanable funds will decrease as the s curve shifts to the right to become. The theory of loanable funds is based on the assumption that households supply funds for investment by abstaining from consumption and accumulating savings over time. The equilibrium interest rate is determined by the. When graphing a demand curve, the market interest. There is a supply curve for loanable funds (who supply funds to banks etc.?).

The loanable funds theory provides one possible answer to this question. • the loanable funds market includes: Investment and real interest rates 115: When a firm decides to expand its capital stock, it can finance its purchase of capital in several ways. • the loanable funds market is the market where those who have excess funds can supply it to those who need funds for business opportunities.

Demand curve as marginal benefit curve.

Connecting the keynesian cross to the is curve 116: The term loanable funds includes all forms of credit, such as loans, bonds, or savings deposits. Interest rate, r quantity of loanable funds. The aggregate loanable fund supply curve sl also slopes upwards to the right showing the greater loanable funds are also demanded for hoarding purposes that is for the satisfaction of the desire of. When a firm decides to expand its capital stock, it can finance its purchase of capital in several ways. The s + m curve indicates the total supply of loanable funds available at different rates of interest. 2 loanable funds demand curve: The loanable funds market is like any other market with a supply curve and demand curve along with an equilibrium price and quantity. Investment and real interest rates 115: Why is the demand for loanable funds downward sloping? The total demand curve for loanable funds sd and the total supply curve of loanable funds ss intersect at e and give or rate of interest. The demand for loanable funds (dlf) curve slopes downward because the higher the real interest rate, the higher the price someone has to pay for a loan. The loanable funds theory is an attempt to improve upon the classical theory of interest.

Connecting the keynesian cross to the is curve 116: The theory of loanable funds is based on the assumption that households supply funds for investment by abstaining from consumption and accumulating savings over time. The supply of loanable funds curve shifts leftward from slf 0 to slf 2 if • disposable income decreases • wealth increases • expected future income.

Thinking about how real gdp can drive real interest rates watch the next lesson.

The equilibrium interest rate is determined by the. If the supply of loanable funds increases (if people start to save more, for whatever reason), then, ceteris paribus, the price of loanable funds will decrease as the s curve shifts to the right to become. But there's two takeaways here. There is a supply curve for loanable funds (who supply funds to banks etc.?). Connecting the keynesian cross to the is curve 116: The market for foreign currency exchange. • the loanable funds market is the market where those who have excess funds can supply it to those who need funds for business opportunities. Government deficit spending and the loanable funds market: Investment and real interest rates 115: The second curve represents those borrowing loanable funds and is called the demand for loanable funds line. At this rate oq amount of funds are borrowed and lent. It might already have the funds on hand. So drawing, manipulating, and analyzing the loanable funds. More on the fed funds rate. When graphing a demand curve, the market interest.

The quantity of loanable funds supplied is the total quantity of funds available from private saving, the government budget as illustrated in the figure, the supply of loanable funds curve is upward sloping loanable funds. Cross and the multiplier 114:

Source: larspsyll.files.wordpress.com

Source: larspsyll.files.wordpress.com The second curve represents those borrowing loanable funds and is called the demand for loanable funds line.

In economics, the loanable funds doctrine is a theory of the market interest rate.

Source: media.cheggcdn.com

Source: media.cheggcdn.com 26.2 the market for loanable funds 2.

Source: socialsci.libretexts.org

Source: socialsci.libretexts.org • the loanable funds market includes:

Source: us-static.z-dn.net

Source: us-static.z-dn.net Government deficit spending and the loanable funds market:

Source: www.cliffsnotes.com

Source: www.cliffsnotes.com The theory of loanable funds is based on the assumption that households supply funds for investment by abstaining from consumption and accumulating savings over time.

It might already have the funds on hand.

Source: qph.fs.quoracdn.net

Source: qph.fs.quoracdn.net The demand for loanable funds (dlf) curve slopes downward because the higher the real interest rate, the higher the price someone has to pay for a loan.

But there's two takeaways here.

Source: i.stack.imgur.com

Source: i.stack.imgur.com • the loanable funds market includes:

The total demand curve for loanable funds sd and the total supply curve of loanable funds ss intersect at e and give or rate of interest.

Source: image.slideserve.com

Source: image.slideserve.com So once again, the same exact curve, is curve.

Source: apbabbitt.files.wordpress.com

Source: apbabbitt.files.wordpress.com Cross and the multiplier 114:

Source: myincandescentmind.files.wordpress.com

Source: myincandescentmind.files.wordpress.com The quantity of loanable funds supplied is the total quantity of funds available from private saving, the government budget as illustrated in the figure, the supply of loanable funds curve is upward sloping.

The market for loanable funds.

Source: o.quizlet.com

Source: o.quizlet.com Government deficit spending and the loanable funds market:

Investment and real interest rates 115:

Source: img.homeworklib.com

Source: img.homeworklib.com The demand curve for loanable funds slopes downward because consumers and businesses would be willing to borrow more at lower interest rates.

Source: image3.slideserve.com

Source: image3.slideserve.com The loanable funds market is like any other market with a supply curve and demand curve along with an equilibrium price and quantity.

Source: www.reviewecon.com

Source: www.reviewecon.com The determinants of the supply of loanable funds (national savings) and demand for loanable funds (domestic investment + net foreign investment).

Source: apbabbitt.files.wordpress.com

Source: apbabbitt.files.wordpress.com The loanable funds theory provides one possible answer to this question.

2 loanable funds demand curve:

Source: www.researchgate.net

Source: www.researchgate.net 26.2 the market for loanable funds 2.

Source: d2vlcm61l7u1fs.cloudfront.net

Source: d2vlcm61l7u1fs.cloudfront.net For the market of loanable funds, the supply curve is determined by the aggregate level of savings the demand for loanable funds is determined by the amount that consumers and firms desire to invest.

When a firm decides to expand its capital stock, it can finance its purchase of capital in several ways.

Source: i.stack.imgur.com

Source: i.stack.imgur.com The s + m curve indicates the total supply of loanable funds available at different rates of interest.

According to this approach, the interest rate is determined by the demand for and supply of loanable funds.

Source: econ101help.com

Source: econ101help.com The s + m curve indicates the total supply of loanable funds available at different rates of interest.

Source: images.slideplayer.com

Source: images.slideplayer.com Loanable funds interpretation of is curve 117:

Source: welkerswikinomics.com

Source: welkerswikinomics.com Why is the demand for loanable funds downward sloping?

Source: i.ytimg.com

Source: i.ytimg.com 26.2 the market for loanable funds 2.

Source: ingrimayne.com

Source: ingrimayne.com So once again, the same exact curve, is curve.

Source: www.higherrockeducation.org

Source: www.higherrockeducation.org There is a supply curve for loanable funds (who supply funds to banks etc.?).

Source: i.ytimg.com

Source: i.ytimg.com The total demand curve for loanable funds sd and the total supply curve of loanable funds ss intersect at e and give or rate of interest.

Posting Komentar untuk "Loanable Funds Curve"